Navigating a Financial Crisis

When we lived on the Indian River estuary in the United States, it was a common practice to go by boat through the Sebastian Inlet to the open waters of the Atlantic.

Most boaters were aware of the risk of passing through that inlet during the changing of the tide, and the numbers of hapless boaters whose crafts ended up at the bottom of that inlet when they tried it.

There were some who successfully navigated the inlet when the waters were chaotic. We, however, chose the wiser part of valor and arranged our comings and goings for the calmer periods. Yet fishing was possible on either side of that Inlet where the waters remained calm.

This is a bit how we see economic and political changes in the world right now. The entire world is at the changing of the tide. The waters are chaotic because history is being made—we think. Some countries are changing for the better, others being destroyed by bombs of aggressors who appear to be changing for the worst. We consider this a time for basing our decisions on reality.

Will we attempt to travel through? Or will we stay out of those waters until peace returns—if it ever does? Just as we preferred to do on our fishing trips, we choose the safer waters until the changing of the tide is complete.

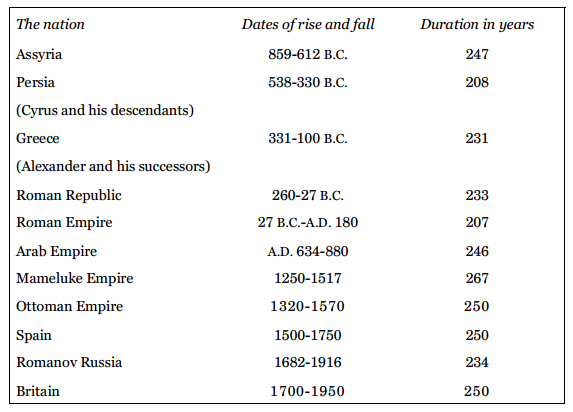

Is it all over for the American Empire? We don’t know but we think it’s possible. History tells us that no empire in history has lasted more than 250 years, more or less. Will the United States break that cycle? Maybe, but reality tells us—maybe not.

But while this seems unthinkable to most of us, it has happened before. We all know about the Roman Empire, but what about the British Empire? The Mongol Empire? The Persion Empire? The Spanish Empire, the Ottoman Empire and we could go on.

In any event, we think it’s time to batten down the hatches and decide which route we will take. For our part, we hope for the best and we also know that every crisis presents opportunity if we are looking for it and are prepared. There is risk–but also opportunity. For example, it is reported that there were more millionaires made during the Great Depression than any other time in history. So while we plan to weather this storm, we suggest planning also for opportunity. We may not see it unless we are looking for it.

My grandmother used to walk with me through her neighborhood and point out houses as we passed and tell me, “If Grandpa and I had had $15.00 we could have bought that house. It went for taxes.” And further along she would show me another one.

Did they have savings? Well that was in the days of silver dollars and my grandfather used to say, “Dollars are made round to go round and I’m going to make them go round.” And he did. You need not bother to talk to him about saving or planning. He died and left my grandmother a widow in her 50’s, without a cent of insurance or savings. Certainly they were not prepared for the opportunity side of depression except that he did have his own business that saw the entire family including three sons and their wives, through the depression. They planted a garden, brought in chickens and even goats for milk. And this was in the city of Miami.

We think a lot of Americans are a lot like Grandpa. And these days banksters have enticed them to take on debt for non-necessities . . . . because debt benefits the banks. When the stock market crashes, which it seems to be trying to do, opportunity is ahead to buy great companies when they cost almost nothing. This is why we say raise cash and hang onto it. Cut spending where possible and prepare in every way possible.

We also believe in developing at least a second stream of income—and a third and a fourth if possible. This is part of our goal to diversify. It is diversification of sources of income. Those who depend on one stream of income are standing in risky territory. Having more than one income is a logical goal. It happens to be one of ours.

We have been researching ways to develop other streams of income. In the coming weeks we hope to suggest some ideas to you including what we ourselves are doing, as well as other ideas that we have collected toward establishing income. So many subscribers have contacted us because they really want to exit their home country but they are concerned about earning a living in South America—and rightly so. So we decided to try to offer some ideas.

We recently suggested beginning to pare down and sell everything you don’t need and raising cash. If you are in the United States, we suggested selling more expensive items on eBay or Craig’s list rather than at a garage sale. If you plan to look for a job in a place that speaks another language, start now to learn that language. If you’re just retiring and not worried about income, and plan to be in a larger city, you can still do well just with English, though we suggest that you do learn the native language—just because it’s fun.

In closing, here is a chart of empires from writings of historian John Glubb

Leave a Reply